well the solution is simple: deport brown people, ban trans people and give more money and tax cuts to corporations and billionaires. it'll all be over soon.

News

Welcome to the News community!

Rules:

1. Be civil

Attack the argument, not the person. No racism/sexism/bigotry. Good faith argumentation only. This includes accusing another user of being a bot or paid actor. Trolling is uncivil and is grounds for removal and/or a community ban. Do not respond to rule-breaking content; report it and move on.

2. All posts should contain a source (url) that is as reliable and unbiased as possible and must only contain one link.

Obvious right or left wing sources will be removed at the mods discretion. Supporting links can be added in comments or posted seperately but not to the post body.

3. No bots, spam or self-promotion.

Only approved bots, which follow the guidelines for bots set by the instance, are allowed.

4. Post titles should be the same as the article used as source.

Posts which titles don’t match the source won’t be removed, but the autoMod will notify you, and if your title misrepresents the original article, the post will be deleted. If the site changed their headline, the bot might still contact you, just ignore it, we won’t delete your post.

5. Only recent news is allowed.

Posts must be news from the most recent 30 days.

6. All posts must be news articles.

No opinion pieces, Listicles, editorials or celebrity gossip is allowed. All posts will be judged on a case-by-case basis.

7. No duplicate posts.

If a source you used was already posted by someone else, the autoMod will leave a message. Please remove your post if the autoMod is correct. If the post that matches your post is very old, we refer you to rule 5.

8. Misinformation is prohibited.

Misinformation / propaganda is strictly prohibited. Any comment or post containing or linking to misinformation will be removed. If you feel that your post has been removed in error, credible sources must be provided.

9. No link shorteners.

The auto mod will contact you if a link shortener is detected, please delete your post if they are right.

10. Don't copy entire article in your post body

For copyright reasons, you are not allowed to copy an entire article into your post body. This is an instance wide rule, that is strictly enforced in this community.

JFC this is depressing. Hopefully it forces some change though. I like that post about the French boyfriend asking why we don't burn shit. Hunger will make people burn shit.

Fucking high rollers over there

My retirement plan is to die at work, that way my family is taken care of. (who am I kidding, my work will try to weasel out of paying them if that happens)

Your family will be lucky to get a pizza party.

The pizza dough contains potassium bromate which may be carcinogenic

Lots of people saying it's a skill issue that people aren't saving more of their earnings. The problem is much deeper: it doesn't make sense for the majority of Americans to save their money. This is the rational outcome of a political and economic system that does not offer hope, only cynicism.

I had several 401ks, I cashed them out fairly quickly because an emergency would come along and it was the only thing between me and homelessness, or not receiving medical care.

Now I have a 403(b) because I work for higher ed, and I am forbidden to cash it out, but I've taken a loan against it and paid off my credit cards, and am paying myself interest now.

So now I have my CCs freed up for the next time I have an emergency, which will be checks watch

Social Security was the single greatest transfer of wealth from employers to employees in US history

Sounds like a good thing

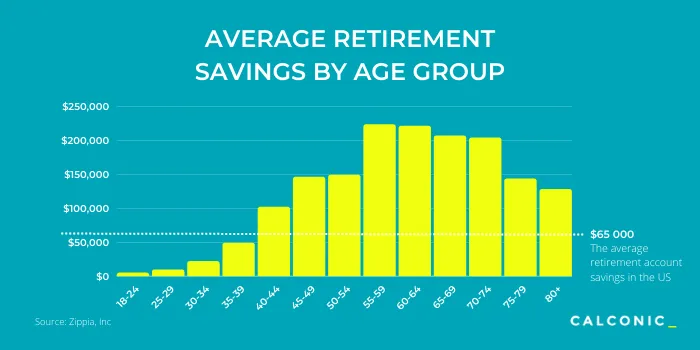

This is a terrible stat. Taking the people who are entering the workforce and averaging them with people who have spent a lifetime working. Not only that, but that’s just “retirement” savings. How many 20 year olds have retirement accounts?

The information would be far more realistic if it were grouped by decade of life.

Edit: Here. This is a little better

Savings

Retirement savings

Still very bleak. Nobody is retiring comfortably on $60k, much less $10k.

Might be worth factoring in SS, as that's the real practical retirement savings people rely upon.

Median, not average, so much better at showing this situation than mean but it's still not great. I agree that it should be broken up, but the difficulty is how you define the grouping will have a significant impact on the results, especially in early and later years.

I'd prefer median by age graphed by age. Average by any grouping will skew heavily if there is a lot of variance, and I absolutely expect there is in the US. A box-and-whisker plot could also be ideal here, but you still have the grouping problem.

Garbage.

Tell me the average of all people who have more than zero (and the number that represents), then tell me how many have zero.

This number 955 doesn't mean shit.

If your employer offers a 401(k) match, not trying to take advantage of that is one of the absolute dumbest financial moves you can make. Yes, I understand people sometimes can’t that’s why I said “try”.

Another move is not investing early. The biggest boost to wealth in retirement is start saving early to take advantage of compounding interest.

I'll upvote for the "try". Most people I know in tight spots need the money NOW. They are barely thinking 1 year ahead let alone 40.

I know people like that too. Those same people don't know how much they spend on anything, don't know where their money is going, and waste money on entertainment (subscriptions), drugs/alcohol, it other stupid shit. I wish they were more aware of their personal finance because I'd hate to see them when they're 55 trying to figure it out at the last minute.

I'm pretty broke all the time, i absolutely know where all of it's going:

- bills

- groceries

- paying off debts from my young and dumb days.

6 more months and i get to have a clothing and sundries budget again

Honestly, comparing my finances to most of the people who have complained to me in person about living "paycheck to paycheck" the majority of people are trying to live middle class on working class incomes. I was guilty of it too, lifestyle creep happened.

I shake my head every time I see people overspending on consumer bullshit while complaining about cost of living like their $20/day for energy drinks is reasonable.

I will say this. It annoys me when I see stuff like. Well these folks are stupid so they deserve it. I have definately known folks who can't do whats necessary to not be messed up in the us and its part of the reason we need real social democratic systems and safety nets. The us has this thing expecting everyone to be a jack of all trades for everything and being smart about every aspect of life. Everyone can't be a doctor, a lawyers, an accountant, a mechanic, and a all the various trades needed to properly handle property. I mean look whats expected with our taxes. Its nuts. Any society should run such that people can work a job and blow their paycheck every week and still do fine. Maybe not high on the hog but have food and shelter and healthcare and transportation and education if they need it. Because if we don't we are going to just create a bunch of problems that then get duct tape type solutions which is pretty much what you see in the us.

Without universal healthcare, even if you save millions, it can all be wiped out with a single illness.

I'm sure the situation is dire, but I'm not sure it communicates an accurate picture by lumping in 21 year olds with people who've been in the workforce for decades.

21 yr olds who are just entering the workforce or are in college aren't expected to have much, if any, retirement savings at that stage in their lives.

A better picture would be to break it down by age group. Still not a pretty picture, I'm sure.

They've done that in the research, it's just a clickbait headline with very, very light details. After following a few clicks I found the PDF [1] in which they break it apart by many groups and factors (age, race, savings plan, income, student loan debt, all sorts of stuff) and that $955 figure falls under the "workers who do not have $1 in a DC" (meaning workers with no access to a savings plan). For those with access, the number is $40,000 average.

[1] https://www.nirsonline.org/wp-content/uploads/2026/02/NIRS_2026-Retirement-in-America-FINAL.pdf

For those with access, the number is $40,000 average.

Which is both in the article and OP summary.

$40,000 still approaches zero. Its one or 2 years of expenses at best.

And you guys don't have a state pension either, right?

You guys really need to get on with a revolution. Work until you die is kinda supposed to be something we are moving away from

There's social security, which does give seniors enough to exist, but not much else.

They have never wanted us to retire. They want us to work until we die.

Soon there will be a critical mass of people who have nothing left to lose. Thats why the Democrats and Republicans need the military in the streets. Their wealthy benefactors cannot allow anything like the New Deal to happen again.

Our lavish lifestyles include paying for food, shelter, healthcare, power and water and it keeps costing more and more but there’s record shareholder profits!!!! Yeah! You should be happy that the economy is great for pedofiles who rape children and possibly(checks notes) eat babies on yachts. Cool! they’re openly using all our tax dollars with the goal of making us working people obsolete while mass surveilling us and killing dissenters in the streets. Awesome

This is Lemmy. You can say pedophile. You can swear. You can call spades a spade without doing wrongspeak that censors you from the algorithm.

I think a bunch of people on here genuinely don't know how to spell the word.

Very misleading stats. What’s the breakdown by age group? A 21-year old with <$1000 in savings is very different from a 64-year old. Talking about the “average worker” across that wide of an age range is totally meaningless. What’s the median age?

I will be so happy eating cat food years from now knowing that I was more prepared than the average person.

How and why would you save as someone in the US? This country is collapsing.

You can invest in international markets if you think the US market is doomed. Still not a reason not to save. The bigger problem is that so many people simply can't afford living expenses AND saving for retirement.