Buy European

Overview:

The community to discuss buying European goods and services.

Rules:

-

Be kind to each other, and argue in good faith. No direct insults nor disrespectful and condescending comments.

-

Do not use this community to promote Nationalism/Euronationalism. This community is for discussing European products/services and news related to that. For other topics the following might be of interest:

-

Include a disclaimer at the bottom of the post if you're affiliated with the recommendation.

-

No russian suggestions.

Feddit.uk's instance rules apply:

- No racism, sexism, homophobia, transphobia or xenophobia.

- No incitement of violence or promotion of violent ideologies.

- No harassment, dogpiling or doxxing of other users.

- Do not share intentionally false or misleading information.

- Do not spam or abuse network features.

- Alt accounts are permitted, but all accounts must list each other in their bios.

- No generative AI content.

Useful Websites

-

General BuyEuropean product database: https://buy-european.net/ (relevant post with background info)

-

Switching your tech to European TLDR: https://better-tech.eu/tldr/ (relevant post)

-

Buy European meta website with useful links: https://gohug.eu/ (relevant post)

Benefits of Buying Local:

local investment, job creation, innovation, increased competition, more redundancy.

European Instances

Lemmy:

-

Basque Country: https://lemmy.eus/

-

🇧🇪 Belgium: https://0d.gs/

-

🇧🇬 Bulgaria: https://feddit.bg/

-

Catalonia: https://lemmy.cat/

-

🇨🇿Czech Republic https://lemmings.world/

-

🇩🇰 Denmark, including Greenland (for now): https://feddit.dk/

-

🇪🇺 Europe: https://europe.pub/

-

🇫🇷🇧🇪🇨🇭 France, Belgium, Switzerland: https://jlai.lu/

-

🇩🇪🇦🇹🇨🇭🇱🇮 Germany, Austria, Switzerland, Lichtenstein: https://feddit.org/

-

🇫🇮 Finland: https://sopuli.xyz/ & https://suppo.fi/

-

🇮🇸 Iceland: https://feddit.is/

-

🇮🇹 Italy: https://feddit.it/

-

🇱🇹 Lithuania: https://group.lt/

-

🇱🇺 Luxembourg https://lemmy.dbzer0.com/

-

🇳🇱 Netherlands: https://feddit.nl/

-

🇵🇱 Poland: https://fedit.pl/ & https://szmer.info/

-

🇵🇹 Portugal: https://lemmy.pt/

-

🇸🇮 Slovenia: https://gregtech.eu/

-

🇸🇪 Sweden: https://feddit.nu/

-

🇹🇷 Turkey: https://lemmy.com.tr/

-

🇬🇧 UK: https://feddit.uk/

Friendica:

-

🇦🇹 Austria: https://friendica.io/

-

🇮🇹 Italy: https://poliverso.org/

-

🇩🇪 Germany: https://piratenpartei.social/ & https://anonsys.net/

-

🇫🇷 Significant French speaking userbase: https://social.trom.tf/

-

🇵🇱 Poland: soc.citizen4.eu

Matrix:

-

🇬🇧 UK: matrix.org & glasgow.social

-

🇫🇷 France: tendomium & imagisphe.re & hadoly.fr

-

🇩🇪 Germany: tchncs.de, catgirl.cloud, pub.solar, yatrix.org, digitalprivacy.diy, oblak.be, nope.chat, hot-chilli.im, synod.im & rollenspiel.chat

-

🇳🇱 Netherlands: bark.lgbt

-

🇦🇹 Austria: gemeinsam.jetzt & private.coffee

-

🇫🇮 Finland: pikaviestin.fi & chat.blahaj.zone

Related Communities:

Buy Local:

Continents:

European:

Buying and Selling:

Boycott:

Countries:

Companies:

Stop Publisher Kill Switch in Games Practice:

Banner credits: BYTEAlliance

view the rest of the comments

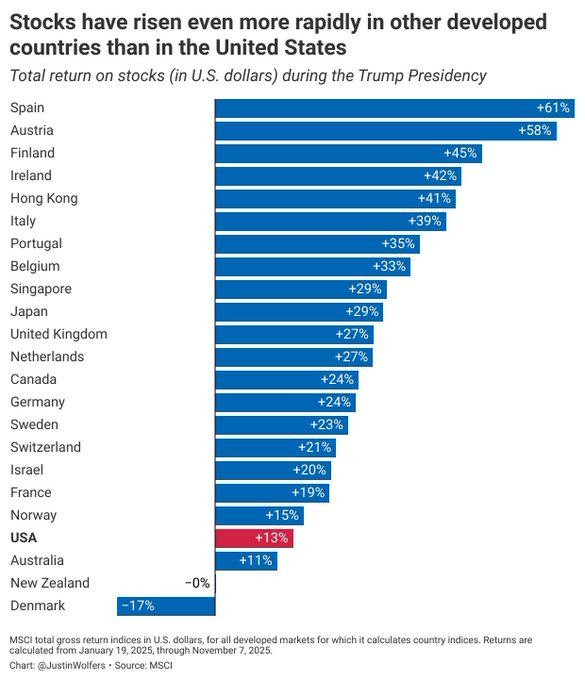

Reminder that this is in USD. Is change in exchange rate accounted for?

Denominating everything in the same currency accounts for it.

No it doesn't.

Stocks are a measure of how much investors think the company can profit. If the value of the euro drops a EU stock won't suddenly shoot up to account for the change in exchange rate from EUR to USD. Same thing with U.S. stocks.

In fact the exchange value of the dollar is going way down so it's actually more reasonable to just use percentage change in listed currency.

You can’t compare countries in different currencies. Picking one numeraire is what makes it apples-to-apples, and FX is part of the real return.

Again. No.

If you used EUR for this comparison everything would be -10% or something

When you compare different countries, you have to look at returns in one currency. Otherwise the numbers aren’t comparable. FX moves are just part of the real return from a global perspective.

Put another way, suppose an American buys an Argentinian asset and then Argentina experiences 1000% inflation but the price of the asset goes up 900%. Are you telling me that you think the Argentinian stock market is doing great? The point of using the same unit across countries is to avoid this issue.

The statistic is comparing percentages, those dont have a currency.

Aa an exaggerated example: If you make a statistic about how much trees have grown in one year and they doubled in size everywhere, it doesnt matter if you measure in cm or inches. But if during that time someone redefines 1inch = 5cm and you only measure in inches, suddenly trees in metric countries didnt grow at all. Weird.

The inch/cm analogy only works if the conversion rate is fixed. Currencies aren’t like that. Their conversion rates change over time. That changing conversion is part of the return when you compare countries. That’s why you need to put everything in one currency first, then calculate the percent change.

Your analogy actually proves my point: if the ‘inch’ changes relative to the cm over time, then you’d have to convert all measurements to one unit before comparing how fast trees grow, even though the percent growth itself is unit-free.

The thing is that if Spanish stock is valued in euros first and then converted to USD, euro to USD ratio might be a big factor in that graph. Euro is above dollars usually but the current exchange rate is wild.

Yeah, but changes in exchange rates are part of the return of the asset. If I buy a Spanish stock from the US and the Euro appreciates then that means the Spanish stock performs better from a global perspective.

Yet the title of the image makes it seem like this is an internal country thing, "stocks have risen more rapidly in other European countries than in the us", then the subtitle corrects it, but the title is implying something different and not necessarily true.

Also, the BuyEuropean community is about European people buying stuff from Europe, not internationals investing in Europe instead of the US, so of your point is correct this post is sorta out of place here.

If you want to have a graph that shows the return on stocks across countries, which is what the title indicates, you have to convert everything to a single currency before calculating the percent changes. It doesn't matter which currency you choose either. It would make no sense to compare the percent changes without this conversion as then you wouldn't be measuring the real rate of return for the assets in each country.

Thinking of it as an internal thing doesn't make much sense to me as the graph draws a comparison across countries.

I don't understand how my point is out of place. I'm addressing the original question about whether exchange rates need to be accounted for.

I did not say post title, I said image title. In any case, the data makes sense, it's just a misrepresentation of the country as a whole because it's not data that's that useful to those living in there.

My first reaction was to interpret the graph as "if you lived there, your stuff would gain value this much faster" but then realised it was literally "if you invested in stock from that country you would gain Y post conversion", so I felt it was a misleading post in a community with the spirit of buy local.

Both titles are accurate.

Even for people living in the country, local-currency returns can be misleading. If your stock goes up 10% but your currency falls 15%, your global purchasing power is down. That’s why exchange rate-adjusted returns matter whether you’re local or international. It measures your real return.

Whether the post fits in this community or not, idk, but the comment I replied to asked an economic question about exchange rates.

Not really unfortunately. Suppose I bought a share for 100€, which went up to 200€ by now. Thats a 100% increase. But if the USD-EUR ratio went up by 100% as well so that my say 104$ share is still worth 104$, the graph would show a 0% increase. In reality, I made a 100% profit. Now of course when considering all stocks, not individual ones, this becomes more complicated but why would using a single currency for this statistic be necessary?

Edit: I see now, the graph is meant to be from a US investors perspective. Title is pretty misleading in that case.