The ones with the absolute most, are, by and large, contributing the absolute least?

Data is Beautiful

A place to share and discuss visual representations of data: Graphs, charts, maps, etc.

DataIsBeautiful is for visualizations that effectively convey information. Aesthetics are an important part of information visualization, but pretty pictures are not the sole aim of this subreddit.

A place to share and discuss visual representations of data: Graphs, charts, maps, etc.

A post must be (or contain) a qualifying data visualization.

Directly link to the original source article of the visualization

Original source article doesn't mean the original source image. Link to the full page of the source article as a link-type submission.

If you made the visualization yourself, tag it as [OC]

[OC] posts must state the data source(s) and tool(s) used in the first top-level comment on their submission.

DO NOT claim "[OC]" for diagrams that are not yours.

All diagrams must have at least one computer generated element.

No reposts of popular posts within 1 month.

Post titles must describe the data plainly without using sensationalized headlines. Clickbait posts will be removed.

Posts involving American Politics, or contentious topics in American media, are permissible only on Thursdays (ET).

Posts involving Personal Data are permissible only on Mondays (ET).

Please read through our FAQ if you are new to posting on DataIsBeautiful. Commenting Rules

Don't be intentionally rude, ever.

Comments should be constructive and related to the visual presented. Special attention is given to root-level comments.

Short comments and low effort replies are automatically removed.

Hate Speech and dogwhistling are not tolerated and will result in an immediate ban.

Personal attacks and rabble-rousing will be removed.

Moderators reserve discretion when issuing bans for inappropriate comments. Bans are also subject to you forfeiting all of your comments in this community.

Originally r/DataisBeautiful

Ah but they're contributing in many other ways! Like, um... uh... let me think for a second...

Hmmm... I'm sure it'll come back to me eventually...

https://taxfoundation.org/data/all/federal/latest-federal-income-tax-data-2024/

I hate to be that guy but the top 5% pays nearly 50% of all income taxes paid.

Don't get me wrong the system is broken.

And the top 10% owns 67% of all the wealth (I'm not seeing an option to show just the top 5%). Considering how many millions and billions of dollars they all own, it only makes sense that they're also paying the most. Especially since they can easily afford it without lowering their standard of living.

Absolutely agreed they can afford it. I just don't like having disingenuous data presented. The % shown makes it look like they're not paying as much taxes as the rest of us. The reality is they pay the most. We shouldn't have to stoop to creating fuzzy charts, we don't need to because the other numbers are even worse, as you have shown. They own 67% of all the wealth, which is insane.

I just don't like having disingenuous data presented

The difference between fighting disingenuous data and reframing the issue to favor another party is the degree in which the so-called disingenuous aspect actually matters.

In this case, the fact that the top 4% pay materially more than the rest doesn't actually matter because they own the vast majority of the wealth. If that same wealth were evenly distributed, more of it would be paid into the system. And that is the point.

What you are doing is not representing the other side of a disingenuous issue, what you are doing is framing the issue in a way that favors the wealthy by citing a statistic that is beside the point.

That in itself is dishonest and a talking point that the wealthy use regularly to try and convince people that they are actually the good guys.

The graph is showing who pays the least as a percentage of family income. I really don't think it's disingenuous to be talking about tax rates as percentages rather than the total amounts paid.

The % shown makes it look like they’re not paying as much taxes as the rest of us.

That's because proportionally, they are paying less. Millionaires and billionaires are paying taxes at a lower rate then everyone else, even though they have so much more disposable income.

I don't know what your ideal version of talking about this would be, but these three facts, that the top 1% pay the least proportionally, the top 5% pay the most in absolute terms, and the top 10% control two thirds of all the wealth, are all related in a pretty basic way.

i'd be ok if we move income tax onto the corpo side of things.

Would mean that it's the companies responsibility to pay that tax, and no longer forces the IRS to go after joe shmoe, who fudged his finger on a 0 while it was still wet.

Or we could also just remove individual taxes, and tax corpos, that's where all money is anyway.

You can't tax companies.

Where do you think business and property taxes come from?

From your pocket. Are you really that naive?

The optimal clearing price for a good or service doesn't map to the tax rate. That's why schemes like a gas tax cut and cuts to real estate rates don't reduce the price of energy or rent. Also why voucher programs and other tax rebates tend to pair with inflationary prices.

Businesses just pocket the gains in the same way they're forced to eat the losses when taxes rise.

Well, I don't know how it works in US, but tax cuts do result in lower prices here in UK. For example, we have 0% VAT on groceries and they tend to be cheaper than elsewhere in Europe.

And no sane business will eat losses, that's how you run out of business. So every tax penny always comes from your pocket. Always.

For example, we have 0% VAT on groceries and they tend to be cheaper than elsewhere in Europe.

The rest of Europe has some strict protectionist policies on food imports to prop up their own agricultural economies. UK is a net importer, so it gets to buy out of both the US and EU agriculture surplus.

Fly over to the US (which doesn't have a sales tax on groceries) and compare prices to Mexico (which also doesn't have a sales tax on groceries). You'll consistently find US prices to be higher because (a) vendors know Americans have more money so they can be charged higher prices and (b) the US is a net-agg exporter and regularly dumps its surplus into Mexican agg markets. This has destroyed the Mexican agg sector and produced a bunch of north-bound migration as a result. But it also makes food rates in Mexico cheaper, as you can bid between local output (produced at lower-than-US wage rates) and surplus foreign imports (sold at dumping rates, because there's too much of it).

And no sane business will eat losses

Businesses routinely eat losses. Some businesses have literally never turned a profit - Lyft, AirBnB, and Reddit have never shown a profit. Amazon famously took 20 years to show a profit, with Tesla and Spotify coming in close behind.

But even after becoming profitable, firms will periodically gain or lose profit margin relative to the prevailing market. A company with a 10% profit margin in Year 1 that sees the marginal rate fall to 8% in Year 2 can't necessarily raise prices to increase profits, because increasing prices will cut into sales volume.

Companies that rely on large pools of customers and lengthy supply chains can and will periodically operate at a loss on the fringes of their business, if they see those fringes as loss-leaders with the potential for growth in future years. Walmart pioneered this strategy back in the 1980s, building unprofitable storefronts in growing neighborhoods under the theory that stacking a claim early on was easier than acquiring property after a development had been completed and filled in.

So every tax penny always comes from your pocket.

Just the opposite. All tax revenue must ultimately come from business revenues, as businesses fund the salaries of the state's labor force. In a state like Alaska or a country like Saudi Arabia, residents get a negative tax based on the gross exports of the local business interests in a given year.

In states like California and New York, the tax base is entirely predicated on the high incomes of locals. And those high incomes are predicated on tech and finance companies paying out enormous salaries. These are functionally taxes paid by the business to employ high-demand staffers, who predominantly live in these states.

States invest in infrastructure to attract workers (most commonly public utilities, police/fire/EMS, and schools). Skilled workers become a magnet for businesses. And businesses pay taxes - both directly to the state and indirectly through taxation on salaries.

Get rid of the infrastructure and public services (as Kansas tried to do a few years back) and you lose the workers. You lose the workers and you lose the businesses. You lose the business and you lose the tax base.

Because, in the end, all tax revenue comes from business activity. If you have a bunch of consumers who do nothing but eat, your state has no real revenue stream.

The rest of Europe has some strict protectionist policies on food imports to prop up their own agricultural economies. UK is a net importer, so it gets to buy out of both the US and EU agriculture surplus.

Britain was part of EU just recently and still has the same policies for the most part. And being a net importer it means that prices should be higher. And they actually did increase after Brexit.

Fly over to the US and compare prices to Mexico

There's no point comparing two countries so far apart in economical development. The prices in Mexico are lower because Mexican labour is much cheaper. You should compare US to similar countries like Canada or European counterparts.

Some businesses have literally never turned a profit - Lyft, AirBnB, and Reddit

You misunderstand their business model. You are not a consumer of their product, you ARE the product. And their business model is not to turn profit on intercations with you, but to milk venture capital. The side effect is that their actual profit is not treated as profit from tax perspective, so they have free money essentially.

A company with a 10% profit margin in Year 1 that sees the marginal rate fall to 8% in Year 2 can’t necessarily raise prices to increase profits, because increasing prices will cut into sales volume.

A successful management will think in decades, not years. Just like a good investor. There are good years and there are bad years, but the balance sheet must workout in the end. Also businesses has plenty of other ways to increase profits: redundancies, wage stagnation, debt, etc.

All tax revenue must ultimately come from business revenues

A business is a virtual entity. No matter how you twist it, taxes are paid by people. A business can't pay shit, it's just a record in the Company House.

Britain was part of EU just recently and still has the same policies for the most part.

That's not true. In fact, it's a big part of the reason the UK economy has been melting down over the last few years

Lol ook. Some random American knows better than a Brit. Ofc.

You don't need to be a Brit to know you've been in recession since February.

Lol ook. Do you even follow the context? Or is it too much for an American?

My guy, get some sunshine and touch some grass. Things will turn around. You're finally going to do a pogrom on all the trans-folks in your country aren't you? That's always good for the economy.

You insane? Call a doctor maybe...

Seriously. Touch some grass.

Seriously. Call a doctor.

Doctor says I'm fine, but recommends you touch grass

This is hard to look at!

Tax the rich!

The rich don't have income, they are not represented here at all.

The rich don’t have income

They certainly have revenue.

And it's taxed differently and not present on these graphs.

And it’s taxed differently

More "taxed not at all".

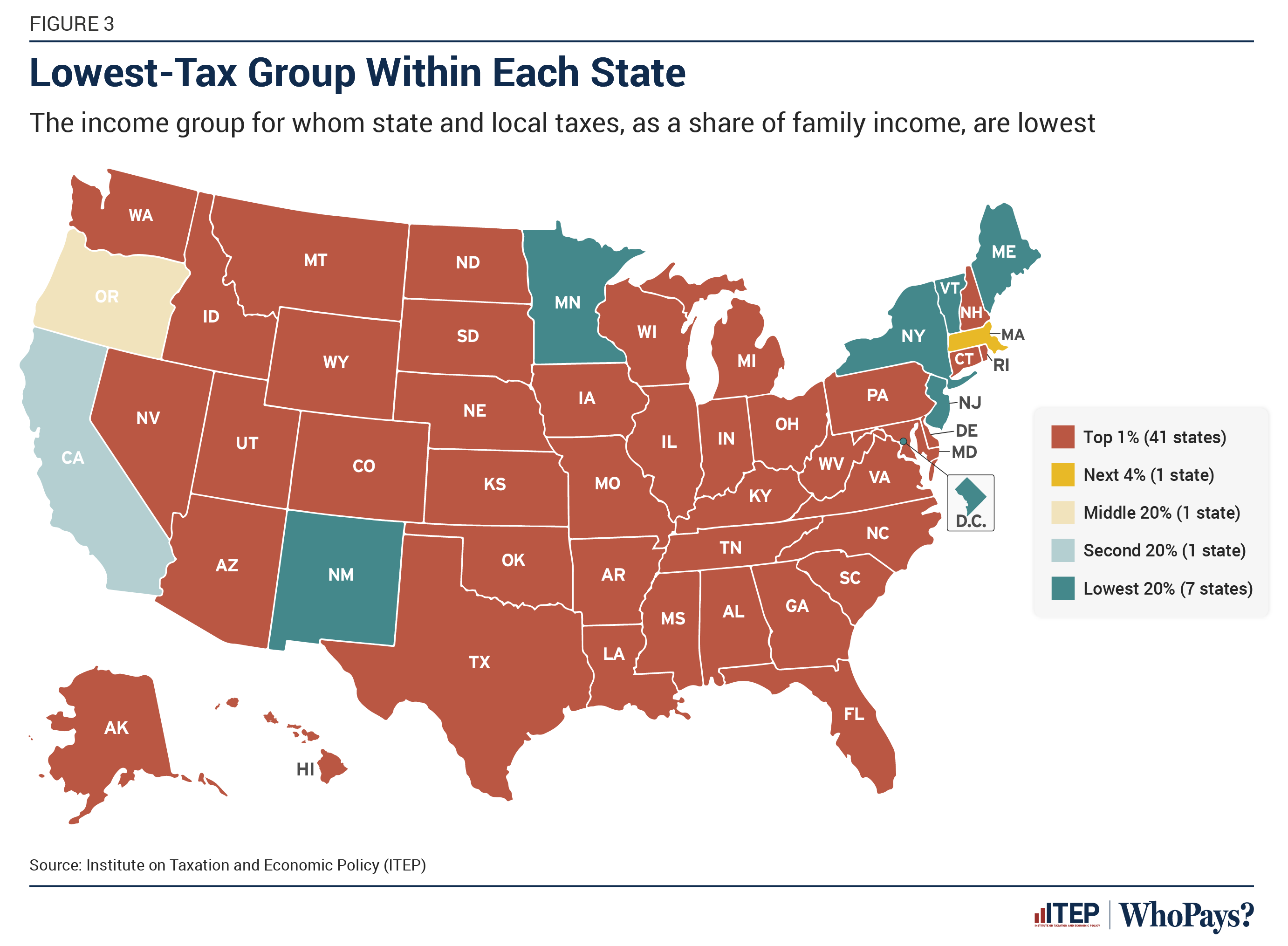

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming all have no state income tax. Am I missing something, or is this graph just misinformation?

Penny power bitches.

Looks like mods gay