Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

view the rest of the comments

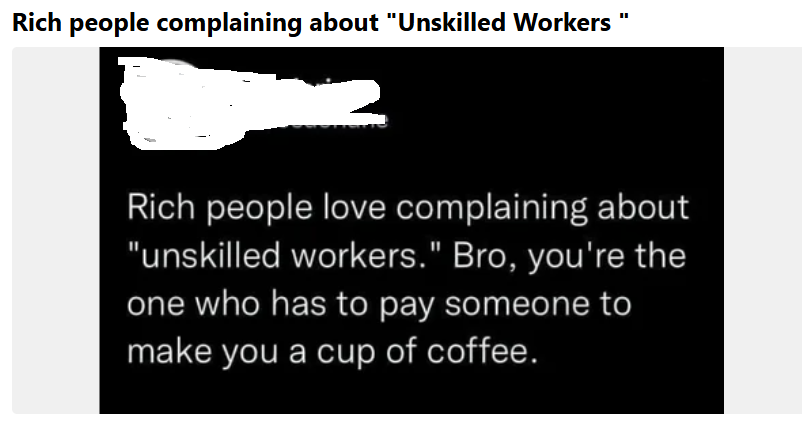

You understand that is a skill in and of itself. Which is why so many day traders end up going bankrupt. To be able to actually consistently make money off of money isn't magical, it doesn't happen automatically. If it did everyone would be far wealthier.

Ever heard of interest? Savings accounts?

Say you just have 100 million sitting in a bank account. The average national savings account interest rate (and you'd get a much better one with 100 million) is 0.42 APY.

So you'd get $420,000 in interest every year.

No, the rich would be richer. It's expensive to make money, but very simple if you have a lot of it. Those without the capacity will keep getting poorer. You can shift the margins by taking more risks, obviously, but you can just make moneys for free when you already have enough for everything you need.

And hmm how is the trend going?

https://www.oxfam.org/en/press-releases/ten-richest-men-double-their-fortunes-pandemic-while-incomes-99-percent-humanity

Oh, right.

Treasury Notes are 10x that rate. This mostly just illustrates how scammy and cheap your average bank has grown.

Yeah, my point here being that even with the puniest of interest rates, you'd still make more than enough just off the interest to live somewhat comfortably. And in reality, you'd make millions and you'd have so much you could risk a little of it while still having those safe investments yielding all the time.

I'd go one step further and assert that wealth compounds and borrowing rates fall with your aggregate wealth. Treasuries are the safest of safe bets, but there are much higher returns to be had with some minimal risk that become accessible when you have large cash reserves and access to cheap credit. Home ownership is a classic example. Save thousands of dollars a year on rent by owning an appreciating asset you get to live in.

You don't need $100M to make this work. $100k can turn a handsome profit through compound returns on investment. In a stock market that yields 7%/year, you double your money in a decade.

Let me start borrowing at the Prime Rate and the sky is the limit. I can take out a loan for 4.3% and invest in an index fund like the S&P that has returned 12.9% APY over the last 10 years. When I'm cleaning up 8.6% on my borrowed money, what's the right number of dollars to borrow? Every dollar I can get my hands on.

Well, thanks for far improving my point with superior elucidation of how it would be actually done.

I thought home ownership as well, but then I thought he'd start complaining about house markets and insurance and whatnot. But we know that realistically it would be beyond easy to make 100 million grow.

thanks again

Sure they increased their money during the pandemic. People were acting like idiots buying homes and goods when they really really shouldn't have. It's also true the rich prey on this. Go try to get 100 million in an interest bank account and see what happens, it's actually harder to leave that kind of money in interest accounts because of how FINRA regulations work. Your money would literally not be insured. You wouldn't know these things because you just hear other poor people talk about the rich and not the actual rich.

Thus, the real crux of the problem. The poor don't even understand well enough what's happening to make a good argument. Between the wanna be rich poor people who talk about unskilled labor as if you just need to pull yourself up by your bootstraps and the poor who hate the rich, no one actually understands how it all works. And it all WORKS BECAUSE you don't understand. If the poor didn't respond the way they did during the pandemic, the rich wouldn't have been able to hoover up all their money. Who's taking the 22% loans, who's buying houses they can't afford on 30+ year mortgages at 8%. All of those actions make the rich richer. You want to stop the rich? Stop wasting your money. But even if you can, the rest won't and the money will keep funneling up. Thus the real problem. But no one wants to change their life style. Instead they'll go out and buy expensive handbags and other luxury items on lay away. You can't stop the rich as long as everyone participates in capitalism.

A lot of words for saying "you're right that one can very safely invest that kind of money and thus I was wrong in saying money doesn't just generate money, when it very literally does".

"I pointed a gun at a guy and asked to fuck him in the arse and he just seemed to agree without question. That doesn't make me a rapist, it makes him a slut."

Honestly I couldn't come up with more hilarious victim blaming if I tried. 5/5 for trolling as a deeply brainwashed libertarian fucknut.

The problem is there is no safe way to invest that kind of money. If there was a purely safe way to invest everyone would be a millionaire. The savings account thing you mentioned is literally only for poor people, to give them a leg up and a small increasing investment for the purpose of teaching people the value of investment. You've created a strawman and keep smacking it.

No, they wouldn't, because investing requires you to have something to invest.

I don't understand why youre fighting against very obvious facts. Money makes money.

Quite literally. You're pretending as if it wouldn't be safe slopping 100 mil into a Swiss bank account, given you're not American and that 100 million was rightfully yours.

"You've created a strawman". No need, honestly. Your trying to argue that it's not incredibly easy to generate passive income for life if had a 100 million to invest.

That's just patently untrue.

There's literally no safe way to invest at that level. Do you understand what the FDIC is and what they do? Do you understand what an accredited investor is and why they can invest in riskier vehicles? Did the words I just write look like word salad to you?

Nothing is completely safe, but it's ridiculous that you're pretending like it'd be any issue to make 100 million grow if you magically got a sum like that.

Yeah, the FDIC is a an American institution. Most Swiss banks don't deal with Americans.

What you're talking about is actively investing. I'm using "invest" in it's basest form.

What is it that you think is so unsafe in slopping a 100 million to a Swiss bank account? Like ofc, nothing is completely risk free, but looking at their history and reliability, what do you specifically think would happen to it? The banks crash?

Get on out of here with your inane libertarian "look I'm a big man in teh money game" bullshit. You're literally trying to argue that it wouldn't be completely trivial to make that kind of money grow.

It's literally not trivial. Again why does the FDIC exist? I didn't say where is it from. What is it for, what does it protect. Who benefits from its protection. Why do investors need to be accredited, why is there higher risk for accredited investors. And this is purely the intro to what I'm talking about.

"This is purely the intro to my garbage avoidance of reality."

I don't need to hear the rest.

The reality is that should someone give you a 100 million and you're of normal intelligence, have no substance abuse issues or debts or anything of the like, it'd be trivial to invest some of that money into hiring professionals who know what they're doing, and that your only requirements are to get, idk 100k a year to use for yourself, and to have it as safe as possible.

You disagree that that would be trivial to do? Soo... avoiding reality it is then.

We're not talking about investing the money to "make money" in the sense that proper investors would with 100mil that they would invest in what they deem to be worth the risk. They expect decent roi for that sort of money. But we're talking about roi that would be enough to sustain a person living very moderately.

That's literally not an issue at all. Although I used "Swiss banks" as a meme, because I know you won't understand the nuances of European institutions and Swiss banks would probably actually charge for holding that money, so you'd want to put it in a German bank more so than a Swiss one. But there's tons of safe options for just putting it in and being able to make HUNDREDS OF THOUSANDS of interest a year.

And your argument is that "no no you can't do that what if the world economy collapses completely and money has no value, huh? then you won't have your interest if there's no money in the world!" (I remember someone mentioning "strawmen" earlier...)

That's a lot of writing to admit you have no idea what the meaning behind the words I said. Look if you can't even understand the basics taught in the series 7, you are the target for the rich.

You're just afraid to argue this because you know I'm right.

It's beyond trivial to get a ~100k yearly roi on 100 million.

It's really not. Which is why there are laws around accredited investing and why agents have to learn the Series 7 and follow Finra rules. But if you literally don't understand anything I said, it's obvious why you think it's magic.

Lets put your hypocrisy in a different light. If all jobs require skill, then the job of a financial advisor requires skill because it's trivial to make 100k from 10 million? It's as if your trying to argue that there IS unskilled labor and we should complain about them.

Nothing magical about interest.

It's beyond trivial.

You should never hire a financial advisor. That's like going to see a chiropractor for back pain. What one needs is a fiduciary. And hiring one when you've a 100 million is beyond trivial. And a fiduciary making 100k with a 100 million is beyond trivial.

There's no hypocrisy. All jobs require skill. Being an ultrawealthy cumstain isn't a job or a skill. Money makes money. Small money doesn't make money, but a lot of money will.

Oh dear lord. A fiduciary is a financial advisor. In fact it's the purpose of the Series 7 to make sure they're one and the same. Here's an article on it.

https://wealthadvisors.smartasset.com/fiduciary-costs-benefits-sem1/

Like I said, if you don't even understand what I'm saying, it's not a surprise you're as ignorant as you are.

*Edit: And just so you know, the reason I keep harping on the series 7 is because it forces financial advisors to be fiduciaries. It's the WHOLE POINT of the test. Good lord, how do people like you survive in this world?

*Edit 2: Man this comment. You really didn't know financial advisors have fiduciary responsibility? And yet you knew the word fiduciary? How? How do you exist?

*Edit 3: Wait wait wait, what do you think fiduciary means? I get the feeling you think it means something else.

Again, ignoring the actual arguments to pretend like I'm not making sense.

I'm laughing out loud at the irony of you talking about strawmen. You keep assuming we're gonna work in America, when I've explicitly stated hypotheticals in Europe. But someone might not have the understanding of European financial institutions, would they? And so they'd desperately cling on to the pretense that they hold some arcane secrets with their asinine avoidance of reality. What you're doing is equivocating. (I know you'll have to use a dictionary. :/)

You know exactly why that standardisation is happening. But you're pretending as if I should know the most recent developments in the US, when you don't even understand the very basics of European banking? Seems like a bit of a hypocritical strawman. ;DD

Clearly the point I'm making there is that just like chiropractors, "financial advisers" didn't used to have a fiduciary duty. They're fixing the problem I was talking about. Which you pervert into pretending like I have no idea what I'm talking about. It's utterly ridiculous.

This is my third language. What if I were to be as ethnocentric as you? Oh right, you would seize to have the ability to communicate with me due to you not speaking my language, but me being able to speak your language. Now when I was in business school like fucking 20 years ago, shit was kinda different. That doesn't matter though, as the basic argument you're making is ridiculous ESPECIALLY for someone who seems to (at least attempt to) work in the financial sector.

You're saying explicitly that it wouldn't be trivial for someone with a fiduciary duty towards you to make you 100k when you give them 100 mil to play with? Just how shit of a finance person are you if can't do 100k roi on 100 mil (and yes, of course everything has small risks, but again, aside from the entire world economy crashing)? :D

You're not making any sense. You said to seek out a fiduciary not an advisor. Now you're claiming that some time in the past, which would be distant past btw, that's when I should have seeked out a fiduciary? What you're saying makes no sense. Anyway, EU has the same fiduciary laws for institutional investors like financial advisors.

http://www.purposeofcorporation.org/fiduciary-duties.pdf

So, I don't know what you're on about.

Also, it doesn't matter HOW shit someone can be at their job the reality is it's easy to fuck it up. So, you just admitted it takes skill to be a financial advisor. Congrats you played yourself.

That's the link you just linked in your previous comment. Your link.

Hmm, what's that first sentence there? Didn't bother to get past the title, did you? :(

The Reg BI is from 2020.

So to you "relatively recently" actually means "the distant past"?

I wish you well in your studies, but you really are just sorely wrong about this, and now you're just having a tantrum and trying to assert knowing more, while actually linking evidence supporting how I'm in the right and how I understand that you need a financial advisor who has a fiduciary duty towards you — something which not all financial advisors had until five years ago. See in my language, you wouldn't even understand the words (and Google translate does not work well on Finnish.)

At no point has anyone made the argument that financial advisors don't need skill. But see they're financial ADVISORS, because they don't have the capital to invest.

You're explicitly saying that you couldn't make reliably make 100k roi on 100 million? Man, I hope you didn't pay for your schooling (here in the first world we have free education :P), because if you did, you really need to go and ask for your money back and spend it more wisely.

The money makes the money, as we live in a system of exploitation of labour. The megawealthy cumstains are also exploiting the work of the financial advisors, duh. The megawealthy cumstains still can make hundreds of thousands a year because CAPITAL MAKES CAPITAL.

Squirm all you want you're just utterly wrong and can't address the actual argument anymore so all you have is that childish and pretentious equivocating.

I genuinely do not understand what your talking about. Elaborate?

My bad I was on mobile that was meant for another and I just clicked the wrong reply from notifications. Whops

Well yeah, so do most of the gamblers, but some miraculously don't, but we don't believe that playing rouletts is a skill now. Incidentally, moat of the people who consistently gamble but don't go bankrupt are people who have more money than it's possible to lose in one sitting.

Playing stonks follows exactly the same logic.

Actually you make a great point. Which is why there's professional poker, where gamblers can literally make a living. Understanding the difference between being a professional and being able to consistently make money and where to go to do it, is part of the skill I'm talking about. Thanks!

Not understanding the difference between the game of skill and the game of chance is exactly the grasp on reality that I expected from you based on this thread.

No, your not understanding that games of skill or chance are both gambling. Being able to identify the difference makes you a gambler who can live off his gambling or one who will go broke. Same trick in investing.

That's definitionally not what the word means. But you probably believe that you can predict the streaks in slot machines so I am pretty sure I'm wasting my time here

Bankruptcy is a tool for discharging debt, not a metric for business failure.

You don't bother declaring bankruptcy unless you have creditors. If you're an unsuccessful day trader, nobody is lending you much money to begin with.